Back to Blog

The History of Credit Scores

Early Beginnings

In ancient Egypt, merchants used a primitive form of credit scoring, relying on personal reputations & relationships to determine creditworthiness.

Formal Credit Reporting

Formal credit reporting began in the 19th century.

In 1841, Lewis Tappan established the Mercantile Agency (later known as Dun & Bradstreet) in the USA, collecting & distributing credit information on businesses.

FICO Score

In 1956, FICO (originally Fair, Isaac & Company) introduced the first credit scoring system based on statistical models, pitching its system to 50 American lenders two years later.

Credit Bureau System

The establishment of credit bureaus in the 20th century revolutionized credit reporting. They collected consumer credit information, enabling lenders to assess the creditworthiness of individuals more accurately.

Digital Age

With the advent of technology & internet, credit scoring underwent further transformation.

Online platforms & digital transactions allowed for collection of vast amounts of financial data, contributing to more comprehensive credit assessments.

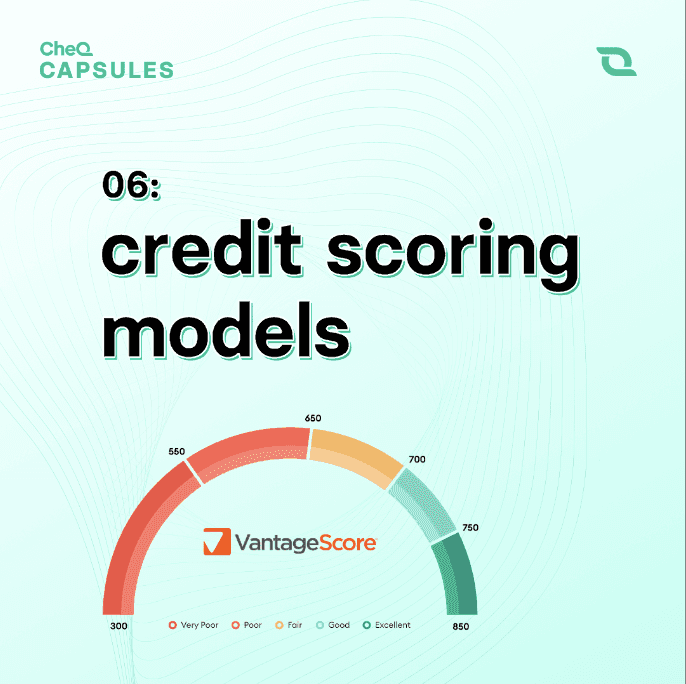

Credit Scoring Models

In addition to the FICO score, various credit scoring models emerged over time.

Like VantageScore, introduced in 2006, which provided an alternative to FICO as a more inclusive assessment of creditworthiness.