Back to Blog

What is a good Credit Mix for your credit profile?

Credit Mix

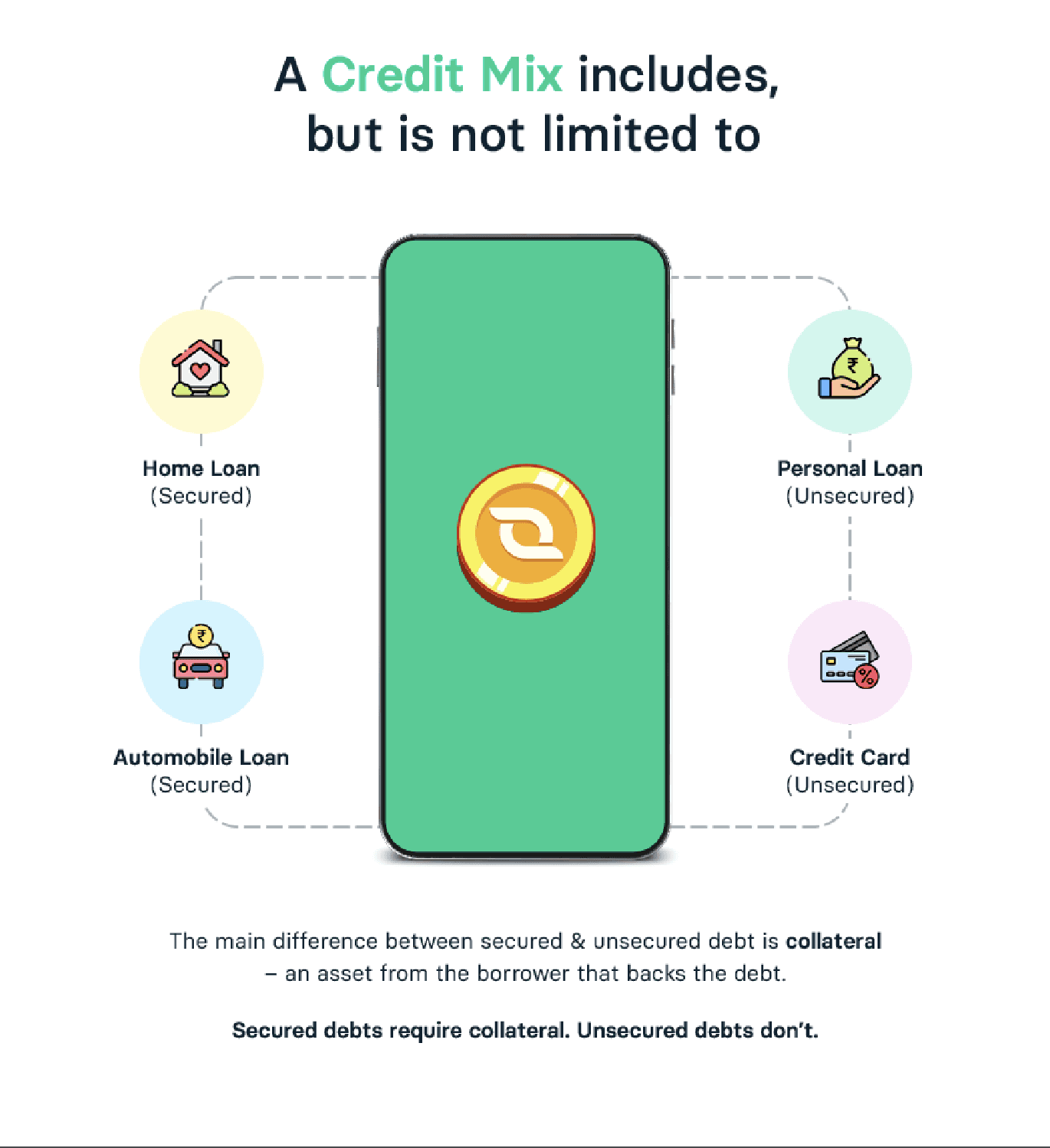

Credit mix refers to the different types of credit accounts you have. Its impact on your credit score varies, depending on the credit scoring model used.

In general, lenders like to see that you have a diverse credit mix – that you’ve been able to manage different types of credit accounts responsibly over time.

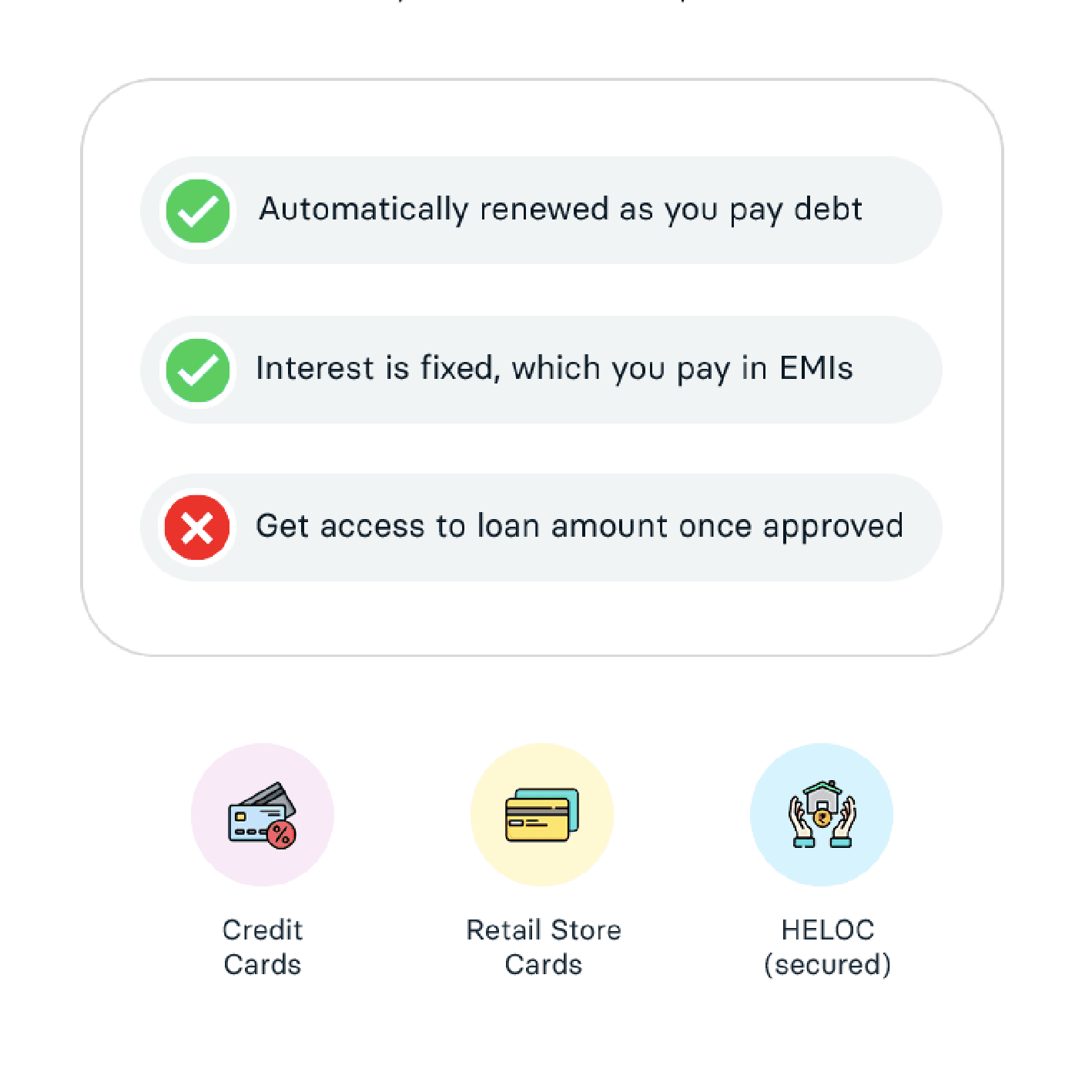

Revolving Credit

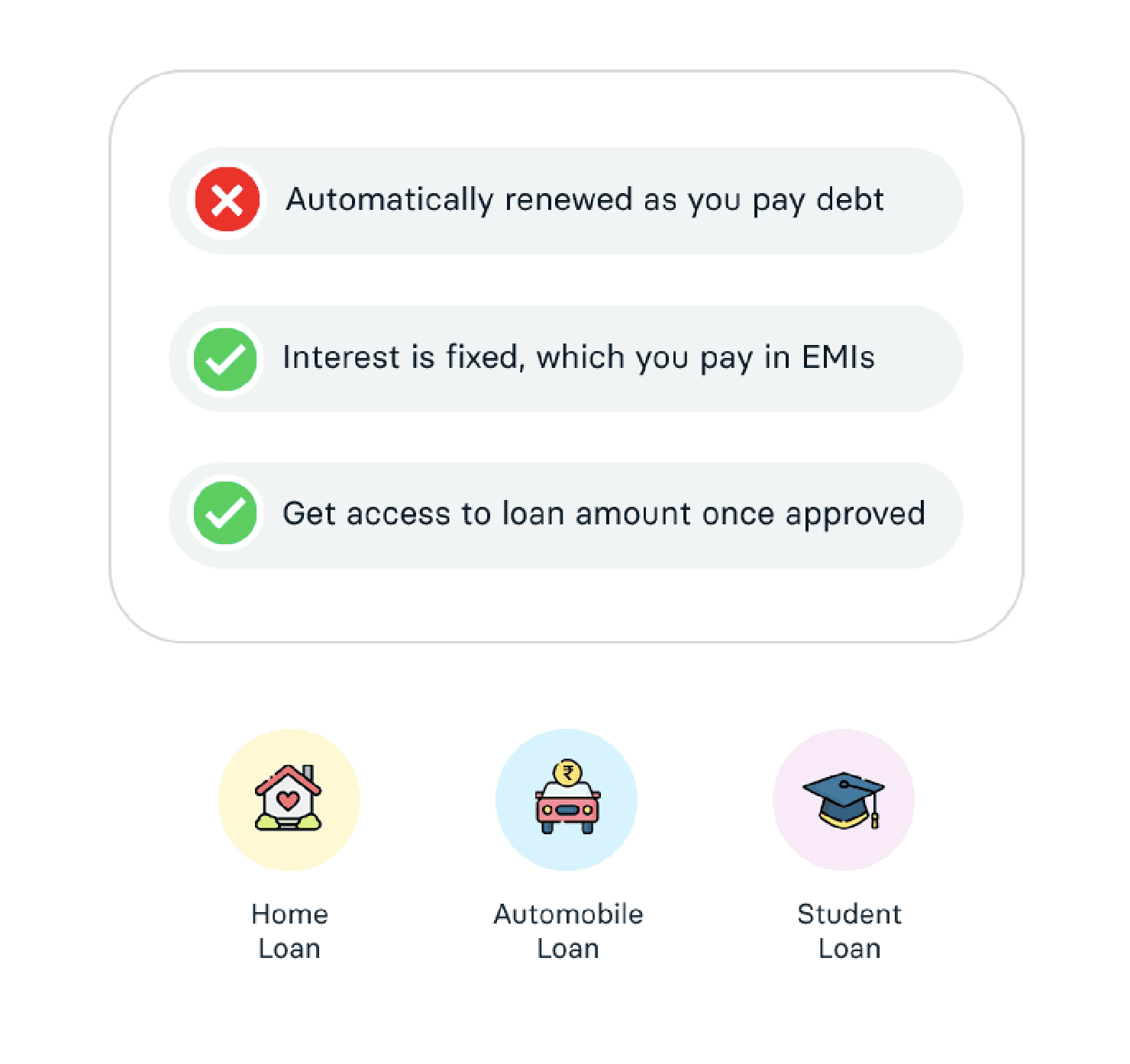

Instalment Credit

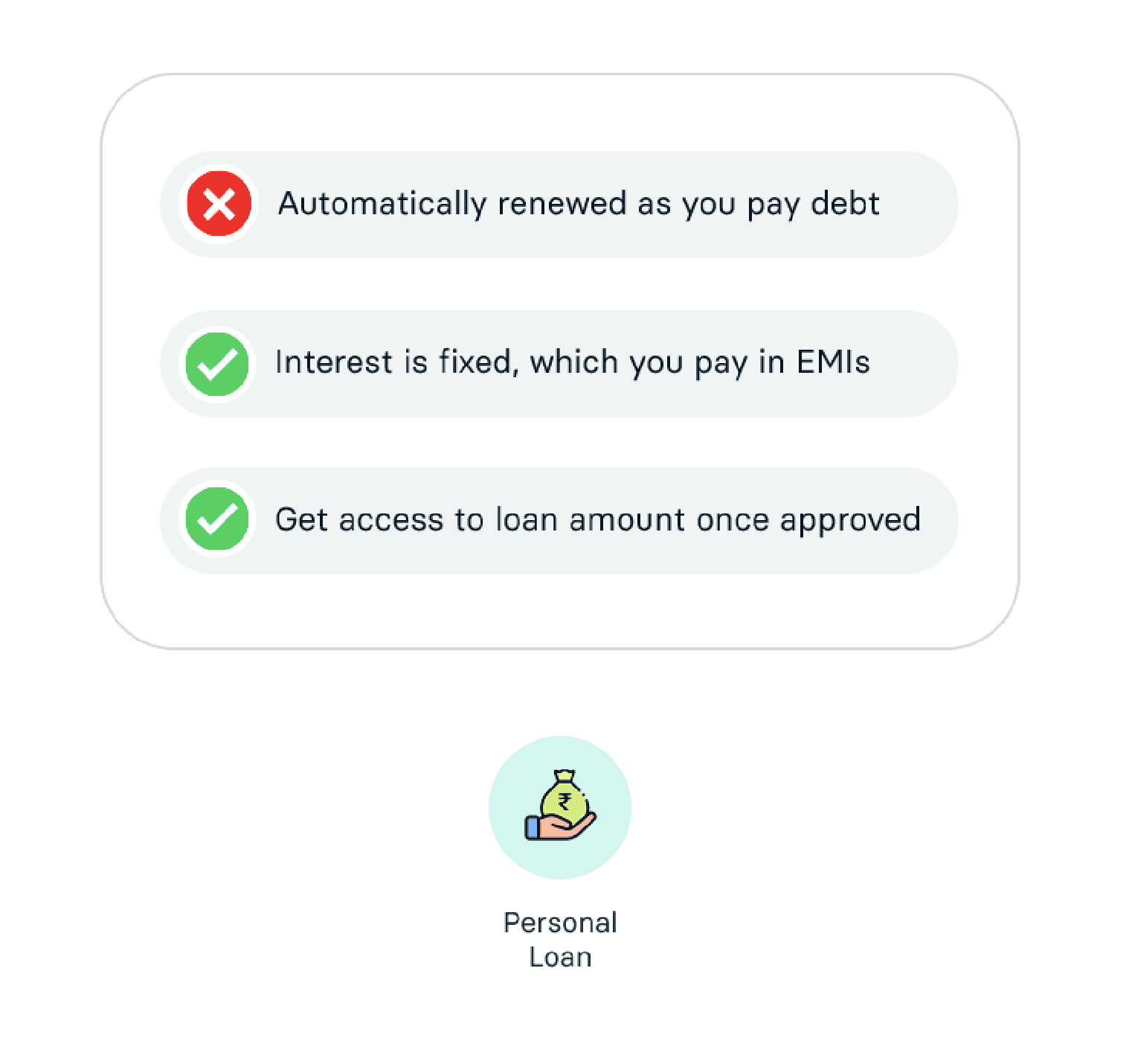

Bank Credit

The Ideal Mix?

An ideal credit mix includes a blend of revolving and instalment credit. Getting a credit card (and paying bills on time) is an easy way to use revolving credit.

If you don't have an instalment loan and only have credit cards, consider opening a small personal loan or other types of secured loan. This will demonstrate your ability to manage different types of credit.

Remember!

Successfully maintaining a diverse credit mix may positively impact your credit score. But that doesn’t mean that you should open credit accounts you don’t need!

Your credit mix is one of the smaller factors in credit score calculations, depending on the scoring model used.

Other factors include the payment history on your accounts, the length of your credit history, your debt to credit ratio, and how much you owe on your credit accounts.